Category: Senza categoria

Gen 29

STARTUP PRE-SEED STAGE: FINANCING AND ADVISORY – Part 1

There is much talk of startups in Italy and there is a strong push by the new legislation on the innovative startups. (So called “startup innovativa”).

More information about Italian legislation on startup innovative.

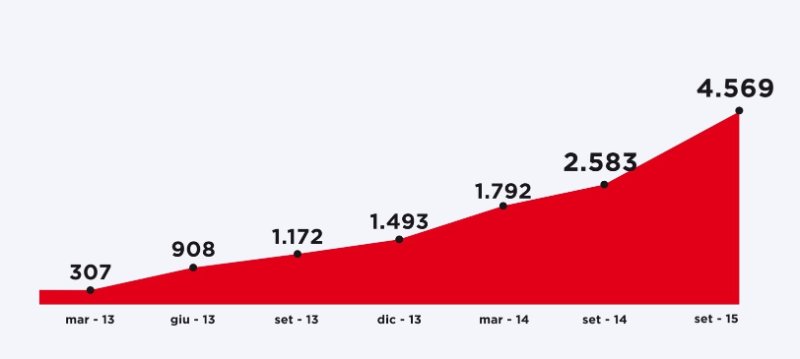

Digitalic has produced an interesting graph on the success of innovative startups in Italy. More than a 1000 are in Lombardy. Which is a clear indication of the favorable environment for startups in this region.

On the market we find interesting startups with quite a mature product, business model and tested management teams of excellence. Typically the stage of scale-up with funding Series A.

And Italy now has its “unicorn”, Yoox. But if we like to talk about startups that have made it, what happens in the stages of development before the growth stage or even early stage?

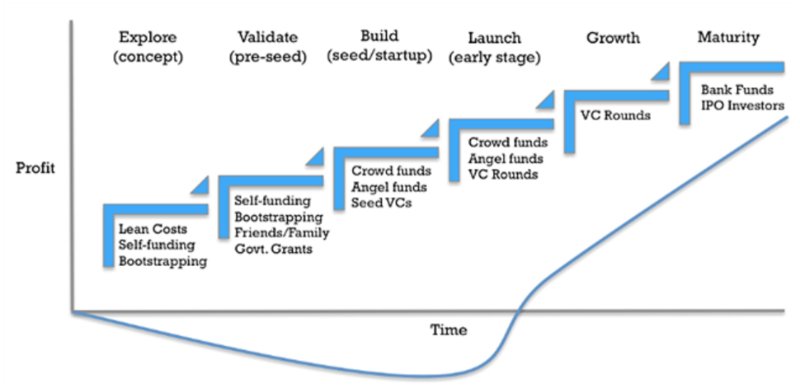

Seed funding is considered as the first round of equity financing for a startup company. I would highlight, though, that the terms themselves to define the type of financing are evolving over time.

The sources of Seed financing include crowdfunding, angel funds and Seed VCs.

Banks usually do not lend themselves to fund and assist in the launch of startups because of the high risks, and venture capitalists tend to stay away from the seed financing. Except the Seed VCs we mentioned.

However, a team of startuppers could have more success with business angels and private equity funds. Or with companies specializing in the very early stages.

Business angels, in fact, are increasingly attentive and professional and are organized into investment clubs and associations.

And there are organizations to facilitate the matching between investors and start-ups, in events where startups can do the “pitch”.

There is, however, a still earlier stage, when there is almost nothing but ideas. And where the startup, most of the times, it is not even formed.

What we call the Pre-Seed stage.

Some care must be taken because the term is not always well defined and is not universally recognized.

The sources of Pre-Seed financing include savings and investments from family and personal friends of the founders.

Surely it is considered the “Valley of Death” from which most business angels stay away, and rightly so, the risks are very high.

But it is a growing sector, where there are several operators active, also in Italy.

We therefore believe it is useful to speak of Pre-seed. In this case the advisory is probably just as important, if not more, than the financing.

This document was first presented at an event at Hotel de la Ville in Monza called 4 Ore S.p.A 2015. Hence the picture at the top.

Original presentation November 2015

More information about our company Creative Thinking Ventures, specializing in the pre-seed stage and startup advisory here: EBN European Business & Innovation Centres Network – profile

José Octávio

Dear Sirs:

It is with great honour that we at UNITED BEEF CORP. (Project/Implementation), salute you, welcome you and ask for your kind attention.

Being at the head of UNITED BEEF CORP. (Project/Implementation), under the leadership of José Octávio A. Tavares, the (“Business Plan”), which is in its Final Stage, seeks to establish and consolidate solid, long-lasting partnerships with “Investors”, in order to achieve its Economic Viability.

That is, benefiting both parties of all its process of market secrecy, so that the hiring of our service providers (Meatpacking and Supply-Chain), are carried out without speculation and fuss in the sector.

Once, by means of a “Joint-Venture”, together with its Strategic Network: (Production and Logistics) Outsourcing: (Slaughtering, Maturation, Boning, Benefiting and Dispatching / Transportation, Storage and Distribution) respectively, it will seek the Assertive Ideal Scale, for the Production of its Appropriate Demands.

With the purpose of focusing and boosting all the Supply Chain Supply Channels of the Beef Production Chain, it will assist the Sector’s Great Capacity, in the primacy of extending to the Internal and External Markets, for Meat Products of Very High Added Value: (“Meat Brands”).

Initially, for Distribution in São Paulo-SP, later, in its entire State, throughout the National Territory (Brazil), and finally, for the Outflow in shipment of “reefers containers”, via the Port of Santos, for Exportation.

And mainly, above all, so that, the shortage of the Domestic Market (Internal), be supplied to Intensify the anticipated Faculty of Previously, both parties, UNITED BEEF CORP. (Project/Implementation) and the “Investors”, to be under a Common Agreement, in what concerns, to refer to the due Elaboration of the Contractual Draft, that will be Presented, Evaluated and Afterwards Discussed.

For so much, having the Common Interest among the Referred Parties, in keeping, in Conformity, with what is being Proposed to them.

And for the good understanding of all, it is being forwarded in attachment, along with this Letter of Introduction, as a preview of our Corporate Business Model, which will be assembled and operated, a brief (“Presentation”) of our Project, in Power Point”, to be analyzed.

In result of the same, having the Answer: Positive, Legitimate and of the Common Interest of Your Part, in giving sequence to our Negotiations, also, will be Sent, via e-mail, Soon in the Sequence, about a (“Confidentiality Agreement”), to be Read and Signed, in 5 Pages.

In this way, in Affirmative Case and Soon afterwards, We will send, for the good Understanding of All, the Summary of Our Provisions of the Economic and Financial Results, for its 1st Year of Activity, once it will contain, Numerical Data of Major Relevance, about All the Main Aspects herein, Described and Portrayed.

Once Approved, we will immediately provide the Forwarding of the: (“Executive Summary”), together with our (“Very Short-Term Execution Plan”), and the same, being Checked and Verified, Facing all its Conformity.

With this, we will Schedule a “Meeting Date”, so that, it will be delivered in hands (Personally), the (“Final Proposal”), so that together, We can Transmit an Open and Comprehensive Dialogue, about All the Main Topics Described in the 3 Relationships, that will be previous to the same, and that in principle, were Elaborated and Well Developed, or still others, when it is Necessary.

Closed the Agreement, is Read and Signed the (“Contract of Capital Contribution”), and in the sequence, by a Specific Accountant, is made the Request of Application, for your “State Registration”, with the opening of your (CNPJ), in the “Board of Trade of São Paulo-SP”, this way, making available, our (“Business Plan Complete”).

Such Documents, were Constituted and Realized, in your more Minute and Due Details, in Special to what refers, your “Strategic-Net”: Production (Joint-Venture/Frigorific), Logistic (Supply-Chain), Players (Competition) and Raw Material (Animals).

Following the Primer and very soon, having the Positive Feedback, by the Investors, we will forward More Details, about More Aspects, that will be Addressed and Discussed Later.

For more, we place ourselves under the entire disposal, for eventual clarifications.

Since now, thank you for your attention.

We will be in waiting.

Thank you.

Sincerely:

United Beef Corp. (Project/Implantation).

United Beef Corp.

Fund–Raising.

IR Investor Relations: José Octávio A. Tavares.

Headquarters (Home Office): São Paulo-SP. Br. / Brazil.

Addresss: Pça. Monsenhor José Maria Monteiro, 28.

Zip Code: 05054-180.

Complement: 13B.

Number Phone: 55+ (11) 3021-42-13.

Mobile Phone: 55 + (11) 99-555-888-6.

E-Mail: unitedbeefcorp@gmail.com.

Linkedin: http://www.linkedin.com/in/josé-octávio-a-tavares-95b382101/.

Marnix Groet

Sorry José

We are not interested.

Regards

Sreekanth

Can we get onto a discovery call to discuss the synergies

Marnix Groet

Hi Sreekanth,

A discovery of what?

What would the topic be?

Regards,

Marnix Groet